Positive start to 2024 for UK house prices

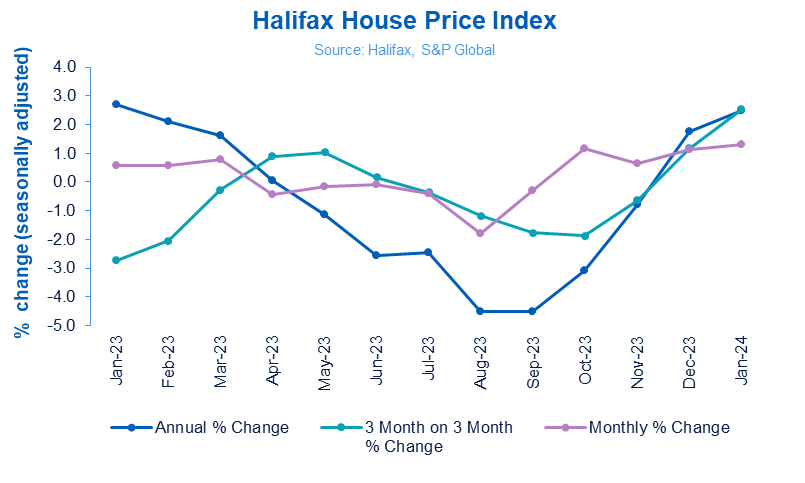

- Average house prices rose by +1.3% in January, the fourth monthly rise in a row

- Property prices grew +2.5% annually, the highest annual growth since January2023

- Typical UK home now costs £291,029, over £3,900 more than last month

- South East England continues to see most downward pressure on house prices

Kim Kinnaird, Director, Halifax Mortgages, said:

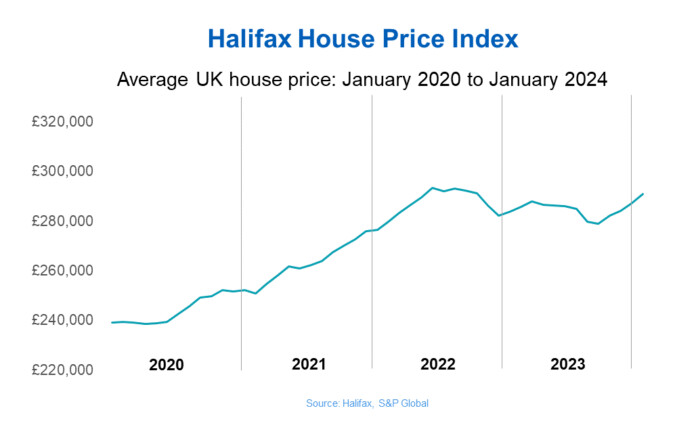

“The average house price in January was £291,029, up +1.3% or, in cash terms, £3,924 compared to December 2023.

“This is the fourth consecutive month that house prices have risen and, as a result, the pace of annual growth is now +2.5%, the highest rate since January last year.

“The recent reduction of mortgage rates from lenders as competition picks up, alongside fading inflationary pressures and a still-resilient labour market has contributed to increased confidence among buyers and sellers. This has resulted in a positive start to 2024’s housing market.

“However, while housing activity has increased over recent months, interest rates remain elevated compared to the historic lows seen in recent years and demand continues to exceed supply. For those looking to buy a first home, the average deposit raised is now £53,414, around 19% of the purchase price. It’s not surprising that almost two thirds (63%) of new buyers getting a foot on the ladder are now buying in joint names.

“Looking ahead, affordability challenges are likely to remain and further modest falls should not be ruled out, against a backdrop of broader uncertainty in the economic environment.”

Nations and regions house prices

Northern Ireland recorded the strongest growth across all the nations or regions within the UK – house prices here increased by +5.3% on an annual basis. Properties in Northern Ireland now cost on average £195,760, which is £9,761 higher than the same time in January 2023.

Scotland and Wales both saw positive growth, +4% on an annual basis to £206,087 and £219,609 respectively. North West (+3.2%), Yorkshire and Humber (+2.8%), North East (+2.0%) and East Midlands (0.5%) also recorded house price increases over the last year.

The South East fell the most last month when compared to other UK regions, with homes selling for an average £379,220 (-2.3%), a drop of £8,866.

London retains the top spot for the highest average house price across all the regions, at £529,528, albeit prices in the capital have declined by -0.4% on an annual basis.